Community colleges can ask the taxpayers to authorize a special tax to pay for construction bonds. They can also issue bonds and repay them using money from the General Fund. Tax-backed bonds – the kind approved by the voters – are fundamentally better because they provide a separate revenue stream to pay off debts. The interest rates on the bonds are lower because the voter-approved tax “guarantees” the repayment of the bonds. Refinancing can actually lower property tax rates in the district, too.

Revenue-backed bonds – those paid from the General Fund – have a higher interest rate because they’re riskier. Revenue-backed bonds are long-term debt, and it’s hard to predict what will happen over 20 years or more. Poor economic conditions, the loss of an operating millage, increases in operating costs and other debts can all put pressure on a community college’s General Fund.

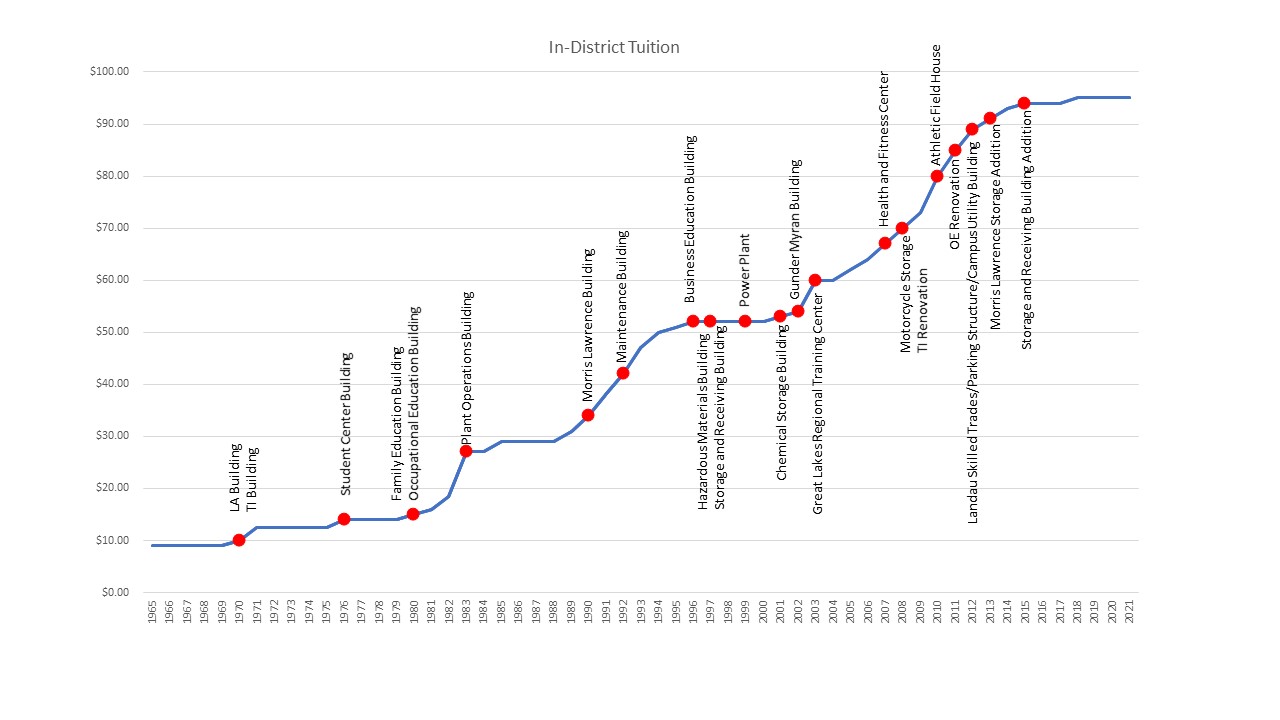

Tuition increases follow revenue-backed construction

For whatever reason, WCC’s Board of Trustees stopped asking voters to back bond issues for construction on campus. The last time WCC asked the voters to approve a bond issue was in the late 1990’s. Instead, the Board authorized the Administration to borrow against WCC’s General Fund.

On one hand, this strategy prevents property taxes from going up to pay for WCC’s capital projects. On the other hand, the taxpayers don’t have a say in what gets built or what they pay for. The more WCC builds, the more it borrows. The more it borrows, the more General Fund revenues it needs to stay ahead of its debts. When the General Fund doesn’t provide enough revenue to stay ahead of the debts, the Board can always turn to tuition increases.

I thought it would be interesting to compare WCC’s historical tuition increases with its construction projects on campus. The blue line in the image above represents WCC’s in-district tuition rate. The red dots represent the building projects in the years they were completed. (Keep in mind that to build, the College needs a lot of money BEFORE the building opens.)

1996 is an important year. It is the last year that WCC asked the voters to authorize a separate revenue stream for bond repayment. The project was the “Technology Education Building” (a/k/a Gunder Myran Building). Although voters authorized the bonds in 1996, the Gunder Myran Building didn’t open until 2002. GM sits on space formerly occupied by WCC’s powerhouse. The College had to construct a new powerhouse before it could break ground on GM.

Tuition increases faster today than in the past

In the first 30 years of operation, WCC’s tuition rose from $9 to $50 per credit hour. That’s an average increase of $1.36 per year. Beginning in 1995, WCC began charging a $2 “student fee.” In 1996, that morphed into a $3 per-credit-hour “technology fee.” The technology fee is now $10 per credit hour, and tuition has risen from $51 per credit hour in 1995 to $95 per credit hour today. That’s an average tuition increase of $1.69 per credit hour per year since 1995. Out-of-district tuition and online learning costs have increased similarly. Nearly half of all WCC students enrolled today are classified as non-residents.

If you look at the graph, you can begin to see the impact of revenue-backed bonds on student tuition increases. In 1992, WCC asked the voters for money to build a Business Education Building and a new library. The voters said “No.” WCC build the Business Education Building anyway, using revenue-backed bonds. Student tuition increased by $9 per credit hour between 1992 – when the voters turned down the bond request – and 1996 when the Business Education Building opened. That’s not a coincidence.

You can also see the stabilizing impact of tax-backed bonds on student tuition between 1996 when voters approved the Technology Education Building bonds and 2002 when the building opened. During that period, student tuition rose by just $2 per credit hour.

Since that time, tuition has soared. Between 2002, when the tax-backed GM Building opened, and 2007 when the revenue-backed Health and Fitness Center opened, student tuition increased from $54 per credit hour to $67 per credit hour – $13 per credit hour to pay for the Great Lakes Regional Training Center and the Health and Fitness Center. Neither of those buildings were meant for WCC students.

Revenue-backed construction can depress enrollment

Forcing students to pay for new construction on campus by raising tuition in lieu of a bond request is absurd. It unnecessarily raises tuition for the students, which increases the cost of attendance. As attendance costs increase, enrollment decreases. To accommodate the drop in tuition revenue, the Trustees must raise the tuition again, and the cycle repeats.

Many WCC students already struggle with poverty. Raising the cost of attendance locks some students out their opportunity to improve their economic position. Those students most affected by tuition increases may not be those who are eligible for Pell grants. Instead, those students who must borrow to attend classes may be most deeply affected.

For proof of this, look at the impact of the Futures for Frontliners program. This free community college option has already received more than 60,000 applications. That’s an average of more than 2,100 students per Michigan community college. When you lower the cost of attendance, you increase enrollment.

And why have we accelerated revenue-backed construction? To build a health club for executives? To wedge an events building on campus that duplicates the intended function of the Morris Lawrence Building? To repair the buildings that the current administration has neglected?

Come on. Washtenaw County students and taxpayers deserve better than that.

WCCWatch: Martin Thomas | WCCWatch: David DeVarti | WCCWatch: Christina Fleming | WCCWatch: Ruth Hatcher