The WCC Trustees are supposed to provide oversight of the ample public revenues WCC receives annually. I have already written about how much the taxpayers give WCC via their property taxes. Despite the almost absurd growth in the value of property in Washtenaw County (and the accompanying increase in property tax values), the Administration inexplicably focuses on how much the State of Michigan does (or does not) contribute. After property owners, WCC students deliver WCC’s second largest revenue stream. The following table shows the student-related revenue since 2015.

| FY | Tuition Revenues | Student Fees | Total |

|---|---|---|---|

| 2015 | $26,969,634.00 | $4,293,203.00 | $31,262,837.00 |

| 2016 | $27,210,714.00 | $4,415,447.00 | $31,626,161.00 |

| 2017 | $27,614,928.00 | $4,310,070.00 | $31,924,998.00 |

| 2018 | $32,539,833.00 | $4,329,464.00 | $36,869,297.00 |

| 2019 | $32,972,647.00 | $4,954,358.00 | $37,927,005.00 |

| 2020 | $32,346,760.00 | $4,403,858.00 | $36,750,618.00 |

| Total | $179,654,516.00 | $26,706,400.00 | $206,360,916.00 |

Between FY2015 and FY2020, WCC students paid more than $206M in tuition and fees. That says a lot because students who attend a community college are often in the lowest income brackets, if they are independent. Education – even at $95/credit hour – is a genuine sacrifice. To generate this $206M, WCC students often work multiple jobs or take loans. Or both.

Loans both inflate their total cost of attendance and add a long-term debt burden to people who have little to begin with. They increase the risk (to the borrower) of attending school. If the borrower’s field of study is not in high demand, or the borrower cannot find a job following graduation, student loan debt can negatively affect the borrower for a lifetime. Literally. According to the most recent figures from the US Department of Education, WCC’s 2016 cohort student loan default rate is nearly 18%. Nearly 18% of students who left WCC in 2016 are in default on their student loans.

What can WCC students buy with $200M?

Back to the $206M. So, what kind of consideration do WCC students get from the Trustees for their $206M? The taxpayers, who provided nearly $310M in property tax revenues during that time, do not get much respect from the Trustees, so it should come as no surprise that the students get even less.

The very best way to understand this is to see it for yourself. (It will take less than 3.5 minutes.) The following discussions took place at a WCC Board Retreat on March 12, 2019. Now, keep in mind that the Trustees know about the tuition rates, revenues, the student loan default rate, etc.

If we’re running a surplus… In this 94-second clip, the CFO has just finished providing a summary of the College’s financial position. WCC is running a surplus at this moment. Trustee Ruth Hatcher wants to know if some of the surplus can be used to help fund more scholarships for students.

“I’m sure you’ve spent it someplace else.” LOLz

If the College is taking in more money than its operations require and the students are having trouble paying for their classes – to the point of needing additional scholarship funds – is it because WCC is already charging too much for its tuition?

WCC students are routinely underrepresented by the Board

We’re going to hit ’em with a 10% increase: David DeVarti and Richard Landau discuss the implications of a $10/credit-hour fee for the students.

DeVarti points out the simple math – that a $10 per credit hour fee (on a tuition rate of $95/credit hour) amounts to a 10% increase in the cost of attendance. This discussion takes place 30 minutes after the surplus discussion and Ruth Hatcher’s request for more scholarship funds, so the Trustees clearly understand that a growing number of students are having trouble paying for their tuition.

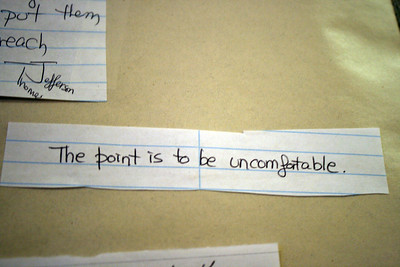

“Where are we going to lose them to?” Richard Landau’s argument for using student fees to fund the cost of a non-academic building amounts to “because we can.” He literally says, “I mean, where are we going to lose them to?”

WCC students are just part of the machine

This statement is super-instructive, and it underscores exactly what’s wrong with the WCC Board of Trustees. To them, education is a commodity that consumers (students) choose based on price. The consumers can choose to go anywhere they want. So, if WCC remains the cheapest available option, it will take in enough students to make its machine work. WCC really isn’t for or about the students; it’s about the self-perpetuating machine.

Except, of course, that some students have no “comparables.” They cannot just fill out papers and start taking classes at EMU or U of M. Sometimes their only choice is between going to WCC and going nowhere at all. DeVarti and Hatcher try to make this point, to no apparent avail.

There is no acknowledgment that educational institutions do not always open their doors to every student. In that respect, WCC is not “comparable” to EMU or U of M or WSU or UM-Dearborn or other schools within a 30-mile radius. Or that residency changes the cost of attendance at a community college. So realistically – for someone who is already living in poverty in Washtenaw County – attending Schoolcraft or Henry Ford, or Wayne County Community College, or Monroe County Community College or Jackson College – is not an option at all.

Worse than all of this – utter silence from Christina Fleming. Fleming is chairing the meeting. When she ran in 2015, she positioned herself as a Trustee who would bring the “student’s perspective” to the table.

At this meeting, however, and at Rose Bellanca’s direction – “We need to move on” – she does just that. Fleming moves on, leaving the students behind.

We need Trustees who are focused on the mission, not on the machine

Instead of directing the Administration to reduce its own expenditures and seek efficiencies to keep the cost of attendance as low as possible, the Trustees look to the students to finance new construction projects, underwrite the growth of the Administration, and resolve the Administration’s long-term neglect of the facilities. In other words, the Administration is not on campus to serve the needs of the students; the students are on campus to finance the Administration.

And that, my friends, is how the Trustees treat their $200M customer. “Here kid, buy this building for us, would ya? And get this other one fixed up! I left my wallet at home.”

We need Trustees who are more responsive to the taxpayers and the students, and less concerned that the president has grown tired of an uncomfortable discussion.

—

WCCWatch: Martin Thomas | WCCWatch: David DeVarti | WCCWatch: Christina Fleming | WCCWatch: Ruth Hatcher

Photo Credit: Quinn Dombrowski , via Flickr