In December, the Ohio Auditor of State published its analysis of the cost of dual enrollment on Ohio’s community colleges. Dual enrollment is the simultaneous enrollment of students who are taking both high school and college courses. According to the audit’s analysis- which used 2022 data – community colleges come out on the short end of the cost stick.

That tracks with Columbia University research released in early 2023, which suggests that dual enrollment is financially unsustainable, particularly for community colleges. In Ohio, enrollment at the state’s community colleges increased by nearly 4.5% in the most recent fall semester. Of that increase, high school students accounted for 1.8% of new community college students.

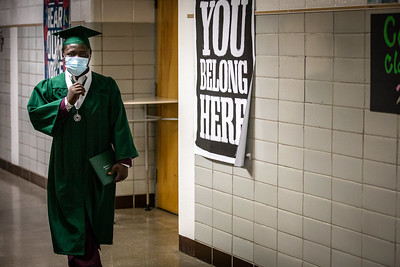

Ohio’s dual enrollment program is called College Credit Plus, and it is available at participating colleges and universities. (All public colleges and universities are required to participate; private colleges and universities may or may not.) It grants free tuition to students who are enrolled in public high schools around the state. Students can take courses in person, on-line, or – if the participating institution offers it – in the student’s home school district. Homeschooled students and students who want to attend classes at a private university may have to pay additional program costs.

Because the number of students who use the program continues to creep upward, the state auditor wanted to be sure that the program properly remunerates the state’s public institutions. The auditor’s report found that the state’s public community colleges bear a substantially larger cost burden because many high school students choose to dual enroll at their local community college.

Dual enrollment may not be sustainable without changes

Ohio’s community colleges have not failed to notice that the actual cost of supporting a dual enrollment student does not quite line up with what the school receives for its troubles. However, they are compelled to participate in the program.

When the auditors restricted their analysis only to the direct cost of providing instruction, a CCP student’s tuition revenue exceeded the institution’s instructional costs at 80% of the state’s community colleges. However, when the auditors looked at all costs – including student support services – the revenue that the CCP program generated did not fully cover the school’s costs.

For example, when auditors calculated both the direct and indirect costs of providing instruction at Cuyahoga Community College outside of Cleveland, the school lost nearly $2M on the College Credit Plus program. CCC is Ohio’s largest community college and sits outside of Ohio’s second largest city, so it is likely to attract a large number of participating students. But $2M is also a large number, especially when it represents money going out.

And it’s not simply a matter of correcting the state funding formula. Institutions receive additional funding based on the number of CCP students enrolled there. The financial benefit of CCP classes depends on how the institution offers classes. Classes that students take online or in person are the most expensive forms of delivery. Classes that take place in the student’s home district are much less expensive because the post-secondary institution does not assume indirect instructional costs.

If nothing else, the Ohio Auditor of State’s report highlights the importance of knowing how much dual enrollment costs the post-secondary institution. Even programs that are popular and increase enrollment numbers may not scale to achieve program solvency.

Photo Credit: Phil Roeder