I have mentioned this before, but a quick trip through the news reminds me of the disadvantages of revenue-backed bonds. In the last week, Santa Monica College (SMC) and the Palmerton Area School District returned tax dollars to their communities. By refinancing previously issued tax-backed bonds, these schools lowered residents’ tax bills. Refinancing lowers tax rates if – and only if – the district’s bonds are of the tax-backed variety.

When the Board of Trustees (or the school board) chooses to do an end-run around the voters and use already-authorized operational dollars to guarantee debt repayment, they foreclose the possibility of lowering taxpayer costs through debt refinancing.

But revenue-backed debt issues are easy. A Board can accomplish them with the stroke of a pen. They do not require the institution to go to the voters and make a cogent case for the proposed investment. Most importantly, they do not raise taxes beyond the standard inflationary raises.

For the most part, however, they display a shocking lack of intelligence on the part of the Trustees. Revenue-backed debt raises the cost of student attendance. If the Trustees authorize these debts frequently, people surviving on marginal incomes cannot afford to enroll. (Despite living in a “rich community.”)

Revenue-backed debt is not like a mortgage

One of WCC’s Board Members compared revenue-backed debt issues to mortgages, in a “Come on, we all do it” rationalization. The reality is that revenue-backed debts are NOT anything like mortgages.

When I take on a mortgage, I take on the full risk of repayment. If I do not have enough money to pay my mortgage, I am the one who suffers. I may subject my family to the pain of default, but at the end of the day, my failure does not materially affect my neighbors. It does not increase their cost-of-living. It does not damage their investment in their homes. When an institution takes on revenue-backed debt, it obligates current and future students to guarantee repayment of the notes. The Trustees may sign the papers, but they don’t pay the bills.

Further, issuers structure revenue-backed bonds as a series of unique annual debt obligations. The debt obligations for the early years of repayment do not look like the debt obligations for the later years of repayment. These debt obligations often grow over time, with the later bonds being both larger and more expensive than the earliest bonds in the series. Students who enroll 10-15 years into the future will pay a larger portion of the school’s debt obligations than those who enrolled soon after the Trustees issued the bonds.

Institution’s revenue-backed debt obligations are not apparent

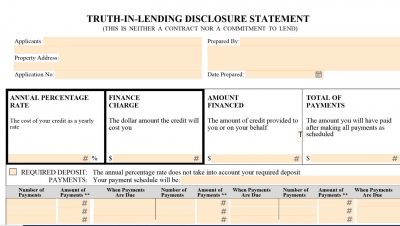

Unlike mortgage lending, the law does not require a public borrower – like a community college – to disclose its future debt obligations to prospective students. Students deserve a “truth in lending” statement. They deserve to know how much of each tuition dollar goes toward repaying the College’s revenue-backed debts. This level of transparency is necessary when an institution’s Trustees chronically prefer revenue-backed debt over tax-backed debt.

For example, if the institution’s annual bond repayment is $1M, and student tuition raises $30M, the debt comprises 3.3% of tuition revenue. If a full-time student pays $1,575 in tuition and fees, $52 of that student’s tuition will go to pay the institution’s debt each semester. As the institution’s bond debt rises, so will the student’s repayment cost.

That $52/semester for four semesters will require the student to repay more than $50 in student loan interest on top of the $208 principal debt. Collectively, if students enroll in 250,000 credit hours per year at a tuition rate of $105 per credit hour (with fees), more than $866,000 in student tuition revenue goes to repay institutional debt. If 65% of the students in any given year borrow to pay their tuition, those students will pay an additional $139,000 in student loan interest to satisfy what amounts to the school’s debt.

Disclosure requirements would eliminate revenue-backed bonds

Now, you could argue that the school has a lot of revenue sources, and student tuition is only one of them. If you did, I would point you to the discussion in which WCC’s Chief Financial Officer said that WCC did not have enough money to pay for its loan debts and proposed a $10/credit-hour “facilities fee” to cover the repayment costs of the bond issue.

Conversely, with tax-backed debt, the student’s portion of the school’s debt is $0. A relatively small community investment reduces student attendance costs and reduces student loan debt attributable to the institution. Further, it opens the possibility of reduced community cost through refinancing when interest rates drop.

If the law required the school to print each student’s portion of the Trustees’ revenue backed debt on their tuition bills each semester, the revenue-backed debt option would disappear overnight. Students would be outraged if they understood how much they are paying each semester to cover the Trustees’ debts. The community would be outraged that the Trustees have priced the poorest residents out of a meaningful education.

Because frankly, it is outrageous. Revenue-backed debt detrimental to the students and it does a disservice to the community.