Last month, Moody’s Investors Service downgraded the bond rating for Delaware County Community College. DCCC is a mid-sized, two-year college in Media, PA. DCCC is about 16 miles northwest of Independence Hall in Philadelphia. Its most recent fall enrollment was about 8,600 students.

DCCC recently issued $55M in bonds to finance the construction of its new Southeast Campus. Prior to this issue, its bond rating had been A2. The new issue reduced its rating to A3. A3 is still a “prime” rating, meaning that it can be a part of a low-risk investment portfolio, but an issue of that size increases the risk to investors.

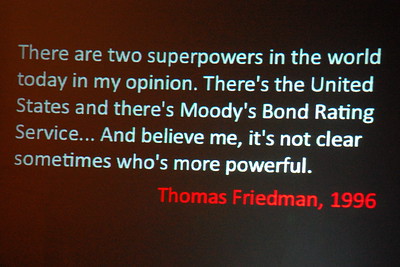

If you’ve looked at higher education bond ratings lately, you will have noticed that – while publicly backed institutional issuers are typically low risk – Moody’s and other rating services have not been kind to them of late. That unkindness translates into higher interest rates on bond issues, and a higher cost of borrowing to the institution.

It’s always very easy to spend other people’s money, so certain institutions and their governing bodies may not care that revenue-backed bonds cost more (sometimes a lot more) than their tax-backed cousins. Avoiding tax-backed bonds is kind of stupid in a way. If a publicly funded institution defaults on a bond issue, the state is usually required to make good on the bond(s). While these bonds are not tax-backed, they are taxpayer-backed. Which is also a problem.

Bond buyers know that the risk of loss is ultimately low – much lower than it would be for a private borrower. They can write riskier bonds because they know the taxpayer will be ordered to stand behind the debts of a public entity in the event of a default. They also know they can charge a higher interest rate.

Lower bond rating means more money for bond investors

These investors really appreciate craven public officials who worry about asking the local property owners for a special tax. Bond buyers also appreciate Trustees who refuse to ask for tax-backed bonds for any other reason. The result is the same: the institution pays a higher interest rate on the bonds, and the investors make more money.

I understand why executives also prefer revenue-backed bond issues. It’s far easier to convince four people to approve the sale of millions of dollars in bonds than it is to convince the 325,000 registered voters in Washtenaw County to voluntarily increase their taxes to finance ridiculous and unnecessary capital projects.

But this type of financing is incredibly disrespectful to the voters whose property taxes fund projects unrelated to education. It also places an undue burden on the students whose tuition rises to pay for each unneeded building.

We need Trustees who are willing to perform actual oversight, and who are willing to prioritize the taxpayers’ interests. We don’t have that right now, and the community is suffering for it.

Photo Credit: Kevin Krejci , via Flickr