COVID-19 has revealed a lot about the state of higher education. High school students are reluctant to enroll in college. Students already enrolled are having second thoughts about completing degrees. Minority student enrollment has tanked. College students dislike online learning. The list goes on. But one of the most critical revelations is the depth of predatory real estate financing deals that colleges and universities have previously agreed to.

One of the great shocks of The Great Recession was that housing values could also decrease. Buyers and lenders alike convinced themselves that housing values could only move in one direction, absent something drastic like a flood or fire. Buyers could be forgiven for making this error. After all, there’s no real harm done if a buyer assumes that the value of his house has risen when it has not. When a lender makes the same assumption, sh_t can get real.

Higher education is learning a similar unfortunate lesson, thanks to COVID-19. Over the past one to two decades, higher education institutions have fallen in love with so-called “public-private partnerships.” Governance boards have convinced themselves that they need a P3 to fund an expensive construction project – like a new dorm. They can be equally charmed by other money-making ventures like parking structures and performance venues.

And that’s the key – “money-making venture.”

Institutions can lose control of projects funded through predatory real estate financing

The private partner in a P3 takes on all of the costs associated with a construction project. Those costs get repaid over time – often 20 years or more. The agreement is a source of income for the public partner, which is leasing land, exclusive access or something similar of value to the private partner. The income projections for the private partner aren’t guesses. If the private partner can’t make its loan payments, the public partner often steps in to make things right.

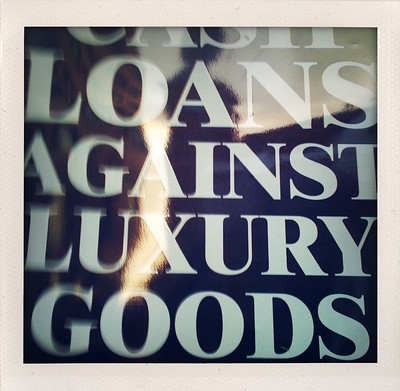

P3 deals may be enticing to a public partner because who isn’t enticed by “free money?” The public partner has to guarantee some level of usage, uptake or whatever to ensure that the private partner makes its money. That’s where the predatory real estate financing comes in. In a normal year, a university could very probably make the usage guarantees with no problem.

In 2020, things were anything but normal. 2021 hasn’t been much better. And the crazy, risky deals colleges made – the ones that were supposed to drive revenue to the private partner – fell apart. That left the private partner on the hook for the full amortized value of the construction and/or operations costs with only a badly damaged income stream for cover.

Predatory real estate financing has brought many a student housing deal back to haunt the governing bodies of higher education institutions. But there are other loan debts that hurt just as much.

And why? Because just like real estate values, revenues can also d-e-c-r-e-a-s-e.

And the losses roll in

In WCC’s case, the Health and Fitness Center lost money last year and will lose money this year. That’s the revenue stream WCC was counting on to pay the building debts. Unlike a true P3, WCC inexplicably kept the hardest part of running a fitness center: the building maintenance. WCC has expenses (and not small ones) associated with the maintenance and upkeep of the building. Those bills still come, whether the building is being used or not. And the loan debts. WCC issued bonds to pay for the construction costs. The loan debts need to be repaid.

All that money comes from somewhere. (Spoiler alert! It comes from the school’s operating budget!

As taxpayers, we elect Trustees whom we believe we can trust to make good financial decisions about the money we supply to the College. The Health and Fitness Center was not, is not and will never be a good financial decision. And the millions of dollars the building is siphoning off of the school’s operating funds prove it.

Worse than making crappy financial decisions, certain Trustees have convinced themselves that their job is to give the administration “advice.” In reality, the Trustees exist to make sure the administration does not make risky, stupid or just outright bad decisions about how to spend taxpayer dollars.

The Trustees counted on the Health and Fitness Center to make enough money to pay the loan debts and stay ahead of the ungodly maintenance costs on the building. They were so blinded by the potential to get a “free” building, that they failed to adequately apprehend the risk they were subjecting the taxpayers to. As a result, the taxpayers will pay in full the building’s extraordinary costs and debts until further notice.

Photo Credit: Tudor Prisăcariu , via Flickr