New data from the New York Federal Reserve Bank shows the surprising change in the country’s reservation wage. If you don’t keep up with the standard Fed reports, the Survey of Consumer Expectations (SCE) monitors information about employment as it relates to age, gender, education, and income.

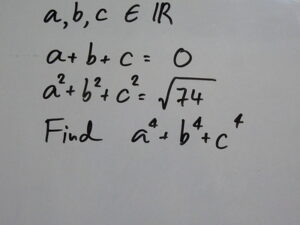

In the SCE, the New York Fed measures a data point called the reservation wage. The reservation wage is the lowest wage that a prospective new employer would have to pay already employed workers to entice them to leave their current employment. It is an average measure, and right now, the reservation wage is $78,645. That’s nearly 8% higher than it was a year ago.

In July 2022, the inflation rate was 8.5%. In July 2023, inflation was a much more modest 3.2%. The point here is that inflation alone doesn’t account for the massive increase in the reservation wage. Keep in mind that the reservation wage is hypothetical. It’s the mean of all responses, which in this survey ranged between $48,000 and $100,000.

The SCE also measures salary expectations among those in the survey who are awaiting an anticipated job offer. It also measures the average number of respondents who expect to receive a job offer in the coming months. In the last decade, the Job Offer Arrival Expectations have declined from 28.5% to 18.7%. This number could be in decline because job seekers are pessimistic about their chances of receiving at least one job offer. It could also mean that fewer respondents are looking for new jobs. For those who actually received job offers, the mean offer wage was $69,475. That’s nearly 12% higher than the mean job offer wage in March 2023.

Actual job offers outdo the reservation wage

The substantial increase in the reservation wage, and the fact that the percentage jump in actual wage offers eclipsed the rise in the reservation wage means something. Fewer workers are looking for new jobs, and employers are improving their job offers to entice those workers who are searching to take their open positions.

This is a function of the tight labor market. Other changes recorded in the SCE data back this up. These include the number of workers who were unemployed during the survey period, and the number of job offers that older workers (those over the age of 45) received. Employers are often reluctant to hire older workers, but when fewer workers are available, employers will hire whomever they can find.

The wage data show that job seekers expect a salary floor of $40,000. Community colleges, whose program graduates struggle to make $35,000 ten years after first enrollment, haven’t improved their programs well enough to get their graduates into the game. The opportunity to place graduates into high paying jobs in a worker’s job market is here. Community colleges have had more than a decade to develop new, high-wage programs for their current and future students, but they’re coming to the table empty-handed. (It’s kind of like showing up to class without having done your homework.)

The adage, “Strike while the iron is hot” applies here, but so does Louis Pasteur’s advice “Chance favors only the prepared mind.” Our community college graduates are largely unprepared to take advantage of the hottest job market since the end of World War II.

As the taxpayers who have invested billions of dollars into our community colleges, we have the right to demand an explanation.

Photo Credit: The Crucible , via Flickr