Earlier this year, the Federal Reserve Bank of St. Louis updated an annual study called The State of US Wealth Inequality. (Initially, the St. Louis Fed titled this report The Real State of Family Wealth.) As you might expect, it’s not pretty. The so-called wealth gap is real on several levels. It explains why Millennials and Gen Z look twice at the value proposition of a college degree.

No matter how you look at wealth – by generation, race, gender, educational status – there’s a pronounced and growing gap between the “haves” and the “have-nots.” That gap is growing, as it has been for decades. They are persistent and will remain so if we continue to manage the inputs to wealth and inequity the same ways we always have.

According to the report, as of Q4 2022, 10% of US households control 68% of the household wealth in the United States. That leaves the other 90% scrambling to get some of the remaining 32%. This is important because most of the workers with community college degrees (or “some college, no degree”) live in the 90%. To put a finer point on this, the bottom 50% of US households have an average wealth of $59,000, which is 3% of the whole pie. It might go without saying, but that means the top 50% of households control 97% of the household wealth in the US.

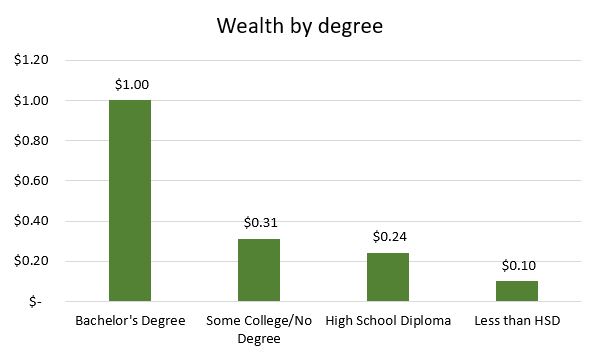

That’s one way to look at the gap. Another way to look at wealth inequality is by looking at how education affects the distribution of wealth. The St. Louis Fed report compares the wealth of people with a bachelor’s degree to the wealth of people with other levels of educational attainment.

Closing the wealth gap will require administrative leadership

The chart below describes the wealth gap in educational terms. For every $1 of household wealth that a person with a bachelor’s degree has, a person with some college/no degree has $0.31. A person with a high school diploma has $0.24 per $1 of wealth that a bachelor’s degree creates and a person without a high school diploma has $0.10 per $1 of wealth.

There are two problems with the graph. First, a bachelor’s degree creates a wealth gap of 3.23x between itself and some college/no degree, which includes associate degrees.

Second, an associate degree creates a wealth gap of just 1.29x between itself and a high school diploma. That’s just $0.06 more per dollar than a high school diploma. At that rate, it’s very hard to make the case that an associate degree is worth the effort. Why should a high school graduate settle for a $0.06 per dollar rise in household wealth with an associate degree when with two additional years in the classroom, s/he can have the whole dollar?

It is time for high-paid community college administrators to rethink the academic strategies their institutions have been applying. If community colleges want to compete for students, their administrators will need to ensure that their academic programs can move the needle on wealth farther than $0.06 over a high school diploma.

If one spends two years earning an associate degree, then the wealth gap between a bachelor’s degree and an associate degree should be no larger than $0.50. At $0.24, a high school diploma is worth about one-quarter of a bachelor’s degree, which seems about right.

Where is the value in an associate degree in 2023?

Photo Credit: Kate Ter Haar , via Flickr