Yesterday, I wrote about the lack of accountability for higher education administrators who make poor financial and business decisions. Often, those decisions lead to a major budget deficit, which the institution then addresses by laying off staff and cutting instruction. This situation plays out often in any given fiscal year.

One nominee for this year’s Oopsie Award is The University of Arizona, whose Chief Financial Officer announced to the Board of Trustees in June that the school had nearly four months of cash on hand. Earlier this month, she informed the Board that the school now had only 97 days of cash on hand. (Expressed as an actual number, that’s a budget deficit of $240M.) Upon learning of the cash problem, U of A President Robert Robbins informed the Board that he had no idea the school had cash problems.

The cash-on-hand is significant because the Board requires the institution to always have available at least 120 days of cash. In what amounts to a stumbling explanation, the CFO said that the school’s newly acquired budget deficit was the result of a revenue projection model that “exaggerated” the amount of available cash by 30% or more. For what it’s worth, the school now uses a different cash projection model.

The CFO spilled the tea in a report to the Board of Trustees that described the errors that impacted the school’s available cash. As it turns out, the school pumped additional cash ($55M) into the athletic department using the ludicrous assumption that increased spending on athletics would somehow bring in more money. It did not. (Note to savvy investors: collegiate athletics as a whole are not money-makers.) This “loan” to the athletic department is being repaid at a much slower rate than the administration expected. (See previous note.)

Budget deficit has roots in bad decisions

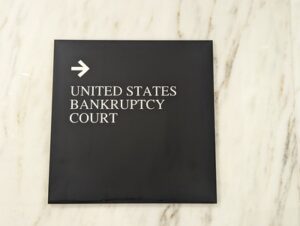

Also failing the sniff test were the assumptions that the University made when it purchased the formerly for-profit, private Ashford University for the low, low price of just $1. The university then transformed it into University of Arizona Global Campus. As it turns out, that practically free university swallowed more than $265M in operating costs in the first year alone. (To be fair, that was offset by $40M in revenues.) Put another way, University of Arizona Global Campus operates at a budget deficit of 85%.

Still unresolved is the $72M fraud complaint the Department of Education has with the ashes of Ashford University. The University of Arizona might end up eating those as part of the sale.

Besides the loan to the athletic department and the online university’s enormous operating costs, the CFO’s report pointed to inflation, student financial aid costs, and market-rate salaries for employees as additional contributors to the school’s budget deficit. (The CFO did not volunteer to take a salary reduction as a demonstration of leadership.) Instead, she informed the Board that “hard choices lie ahead for the university.”

Those “hard choices” could impact hiring, student financial aid, and selling university-owned assets. Additionally, the university might have to consider discontinuing the “generous discounts” it currently gives to out-of-state students. (Why do publicly funded institutions feel compelled to use tax dollars on a large scale to underwrite the educational costs of non-residents?)

Notice that none of the corrective options include firing the administrator(s) who created the problem.

Photo Credit: Jamie Bernstein , via Flickr