Very few (if any) community colleges in Michigan have not laid off employees, or cut budgets and programs in response to the pandemic. But how the community colleges fare in the long term will depend heavily upon the college’s revenue balance.

A community college in Michigan has three primary sources of revenue: local property taxes; student tuition and fees; and state appropriations. For sure, each community college has “other” sources of revenue – like rents, licensing, continuing education, investment income, etc. – but the majority of a community college’s revenue comes from these three sources.

No two community colleges in Michigan have the same proportion of property tax revenues, student tuition revenues and state appropriation. These revenue elements depend uniquely upon each college’s circumstances. Residents within the district control how much property tax revenue they give their community colleges. Student enrollment depends on a wide range of factors and can even vary significantly from semester to semester, depending upon mundane factors like the weather. The Legislature controls the state appropriation, which varies from year to year and depends on the application of a complex formula that considers several factors.

It’s becoming clear that a community college’s revenue balance will determine how well it will weather the pandemic. Community colleges that depend more heavily on student tuition for revenue aren’t faring as well.

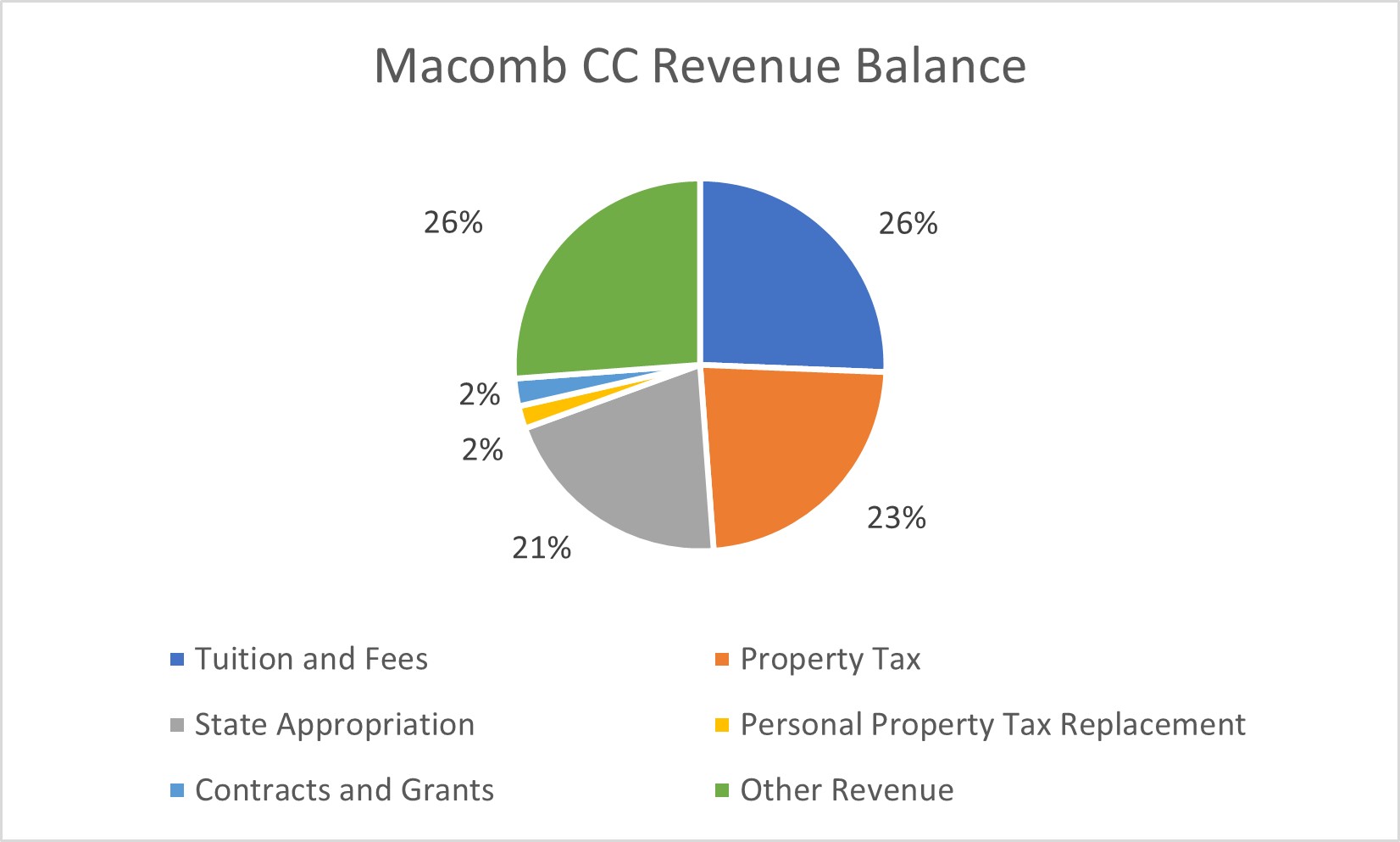

Macomb Community College’s revenue balance

Macomb Community College (MCC) is generally recognized as the largest Michigan community college by enrollment. Its revenue balance (based on FY 2019 figures) looks like this:

In response to a 16% drop in fall enrollment, MCC has laid off more than 500 adjunct instructors and about 100 regular staff.

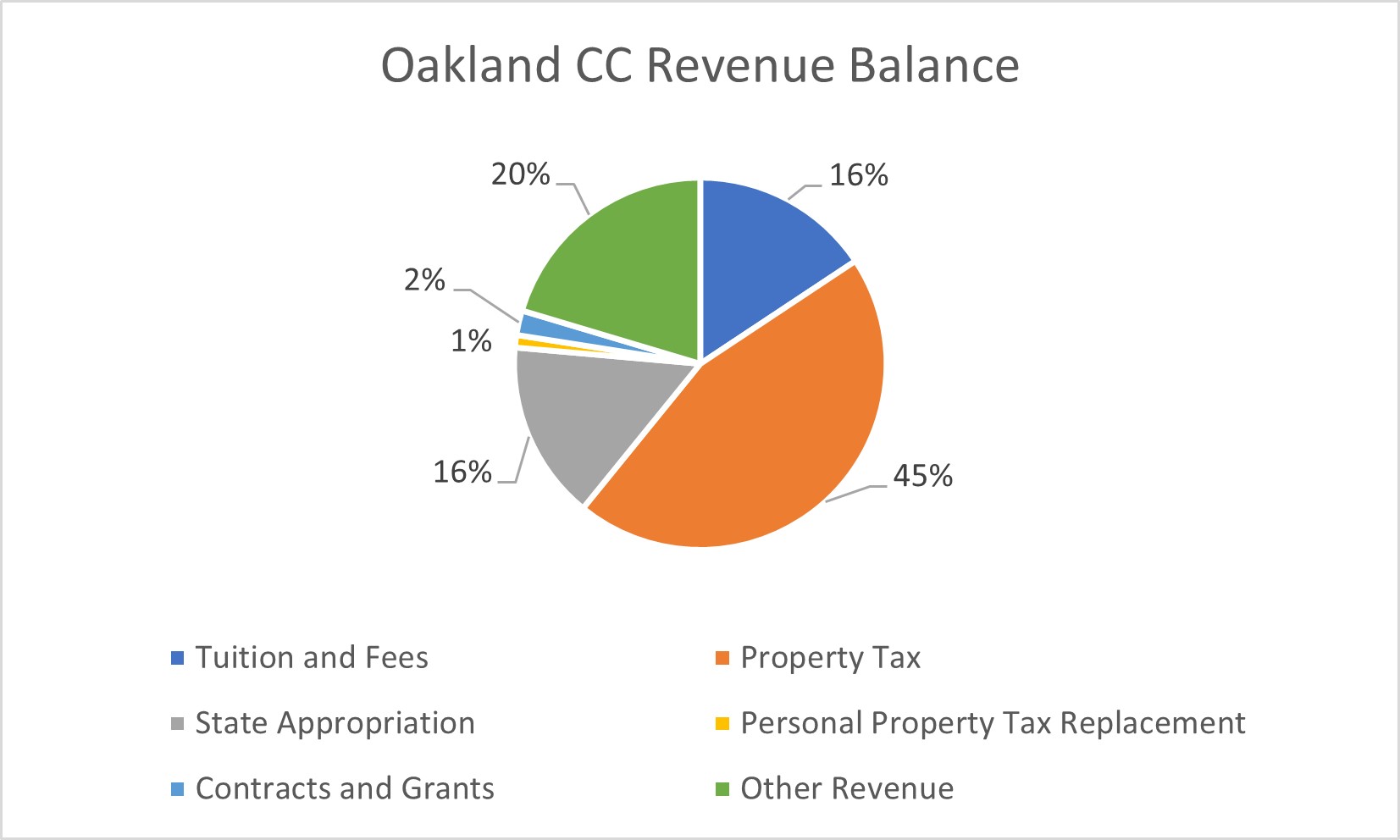

Oakland Community College’s revenue balance

Oakland Community College (OCC) is the largest Michigan community college by revenue. Its revenue balance (based on FY2019 figures) looks like this:

In response to a 9% drop in enrollment, OCC has laid off about two dozen employees, and has since called back all but five.

So, what’s the difference?

MCC depends much more heavily on student tuition revenue and “other revenue” both of which have been badly diminished. Tuition and fees comprise more than 25% of MCC’s budget. Comparatively, tuition and fees make up less than 16% of OCC’s budget. Declining enrollment will seriously affect MCC, while it will have a much less significant impact on OCC. Additionally, the OCC district is more affluent. Students there are more likely to attend college, regardless of the local economic conditions.

Conversely, OCC depends much more heavily on property tax revenues. 45% of OCC’s budget comes from property tax revenues, while MCC gets just 23% from the local taxpayers. Property taxes are a stabilizing factor in community college budgets because they don’t change significantly from year-to-year. In districts where property value exceeds taxable value, property taxes can still rise for several years during an economic downturn.

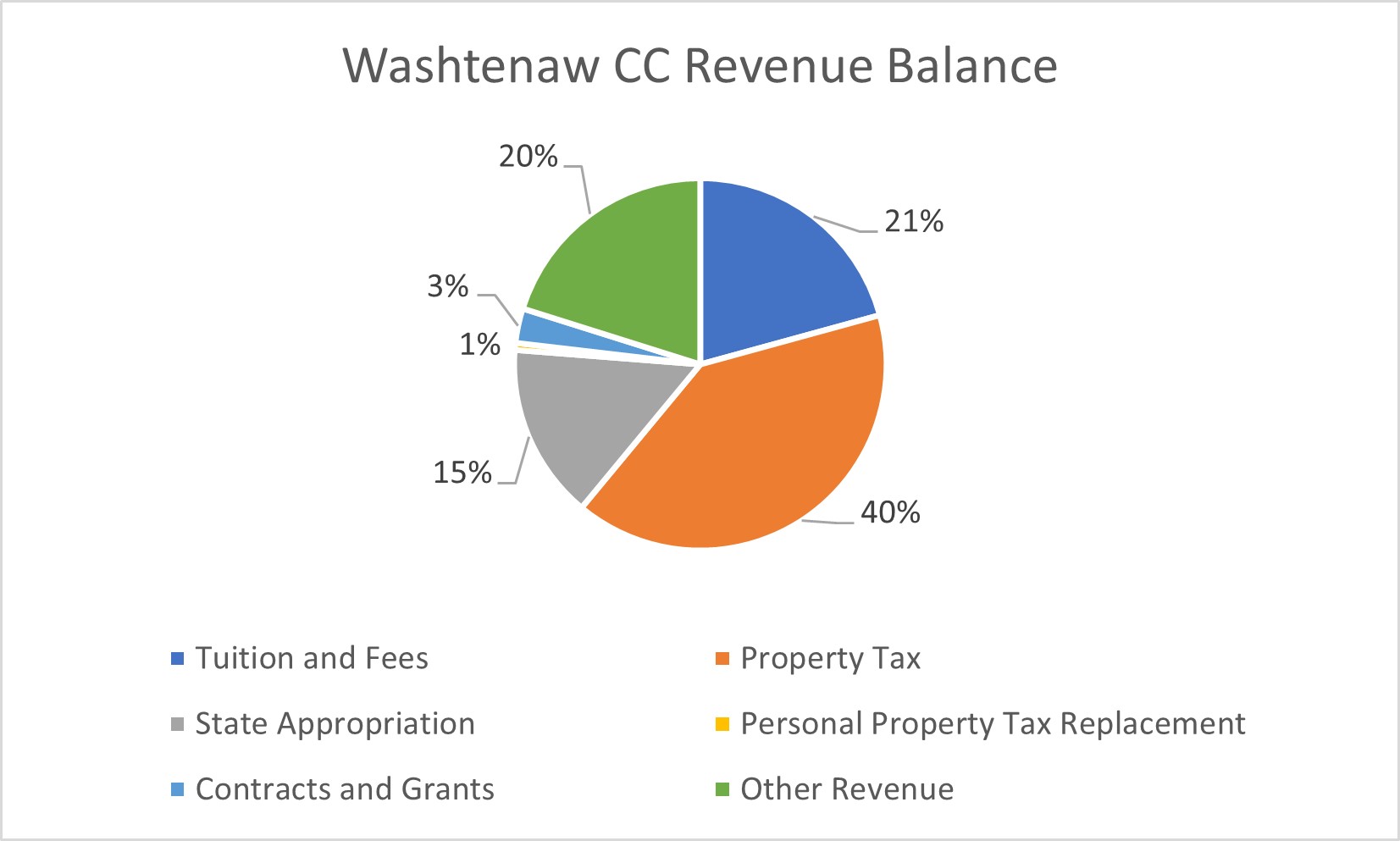

WCC’s revenue balance

WCC’s revenue balance is much more like OCC’s than MCC’s. It receives much more property tax support from the local community and relies less heavily on student tuition and fees.

Further, its target student population – like that of OCC – is more likely to enroll, regardless of the local economic conditions. Fewer student have enrolled at WCC this fall, and credit-hour enrollment has also dropped. But these declines (7% and 4%) are not as significant as they are in other Michigan community college districts.

The takeaway is this:

Community colleges that receive more property tax support will fare better during the pandemic than those that rely more heavily on student tuition and fees. Property tax support is an important revenue stabilizing mechanism for the operation of a community college.

That’s why it is so important for the community college to avoid compromising its revenue picture by issuing bonds against its general fund. The General Fund is meant to fund the operation of the College; it is not meant to guarantee loan payments.

Bond debts can cover a period of 20 years or more. No one can anticipate the institution’s revenue needs that far into the future. Blindly committing a portion of the operating budget every year to pay off debt is foolish, especially because a community college can seek separate tax streams from the taxpayers for capital projects.

Using tax-backed financing protects the institution’s operating funds and better equips it to deal with unexpected events. Additionally, it enables the community college to better assist people who must also cope with the unexpected.

Photo Credit: Thomas Cizauskas , via Flickr