Inflation has been front-and-center since it began its uncomfortable upward climb in March 2021. Rising inflation definitely takes a bite out of the average paycheck. But even when inflation isn’t rising rapidly, it still has an effect. Inflation’s impact on instructional spending at WCC paints an interesting picture.

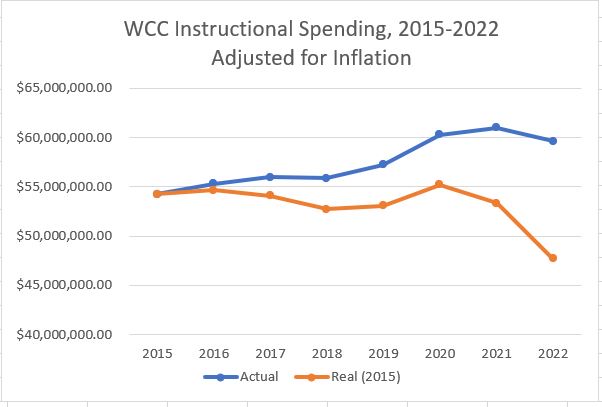

From 2015-2022, instructional spending apparently rose from $54.24M to $60.99M, according to the college’s annual budget. At first blush, it appears that in 2022, WCC is spending $6.75M more on instruction today than it did in 2015.

Except for inflation.

WCC’s spending on instruction, when accounting for inflation (in 2015 dollars), has dropped from $54.24M to $47.69M. That’s a reduction of more than 12%.

WCC is very careful to account for inflation whenever it seeks a millage renewal; it always remembers to ask for a Headlee Amendment override. That resets the property tax collection to real dollars in the year the millage was reauthorized. So, it’s not as though the College does not recognize that inflation matters.

The chart shows the impact of inflation on WCC’s instructional spending over the period in review. The other notable point is that during this same period, the unduplicated headcount for the College increased. In other words, instructional spending fell as the number of students rose.

Prioritizing instructional spending

Like virtually all other community colleges in the US, WCC received tens of millions of dollars in federal aid for COVID-19 relief. The federal government distributed that money through several different programs. Some of those programs had specific spending requirements and limitations. However, WCC’s property tax collects and state aid remained the same or increased during this period, and the federal aid more than made up for tuition revenue losses. Although some program restrictions prevented the college from spending relief funds on certain expenses, other instructional expenses (like the cost of making instruction available remotely) were permitted.

There was no real reason to cut the instructional budget. It’s also important to remember that the decline in instructional spending happened over a longer period. This wasn’t a crisis reduction; rather, it was simply a quiet contraction of the budget. The Administration either “forgot” to account for inflation when budgeting for instruction, or it used inflation as a cover to reallocate funding elsewhere.

We rely on our elected trustees to look out for the best interests of the community. No trustee has publicly raised the issue of inflationary declines in instructional spending. Instead, they hold perfunctory-yet-legally-sufficient “budget hearings” (think 5 minutes or less) in which they ask no substantive questions about the elements of the college budget. It is apparently perfectly acceptable to ask the academic departments at the college to tighten their belts a little more each year in response to inflation.

You can see the disastrous impact that inflation has had on instructional spending in the last year. It is time for the Trustees to enact a policy that requires the Administration to minimize the impact of inflation on the academic operations of the college when creating the annual budget.

Photo Credit: pánicoescénico, via Flickr