The BLS announced yesterday that the June inflation rate was 9.1%. That figure was higher than what most economists projected, and it may prompt a sharp reaction by the Fed. When the Fed meets on July 27, 8 out of 10 economists predict that it will raise interest rates by a full point. Should this happen, the move will have significant impacts on higher education institutions.

The last time the Fed met, it raised interest rates by .75% in the hope that the move would cool the economy down. Yesterday’s BLS announcement clearly indicates that it did not have the desired effect. So, what will happen if the Fed cranks interest rates up by a full percent, the largest hike in history?

The first, most obvious effect would be a rise in interest rates for private student loans. Federal student loans may not be significantly impacted immediately, but those rates may rise next year.

Indirectly, students could feel the effects of interest rate hikes in the form of higher interest rates on car loans and mortgages. Although many community college students aren’t rushing out to get mortgages, many students rent – and their landlords do have mortgages. When the interest rate rises for the landlord, rents rise for students. This sets up a somewhat toxic dynamic: students may resort to borrowing more to cover higher living expenses.

Higher education sector will get squeezed

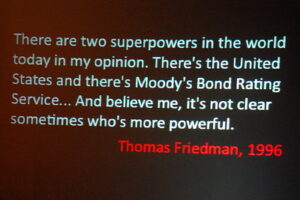

Another obvious impact is in bond interest rates for higher education institutions. If a school wants to build a building and finance it by issuing bonds, it may find that interest rates have risen substantially. That may push the cost of a construction project out of reach for the borrower. Should the school forge ahead with the project anyway, it will likely be greeted with the higher cost of materials and construction labor. Those costs may require the school to scale back the project or borrow more money at a higher interest rate. That, in turn, could require the school to increase the students’ per-credit-hour costs, which would cause enrollment to drop.

Expenses aren’t the only casualty of increasing interest rates in higher education. Increased interest rates will slow down a white-hot housing market. That will cause housing inventory to rise and housing prices to fall. In addition, buyers who purchased houses significantly over market value may find themselves unable to afford their homes. Their other uncomfortable option may be to sell the home at a loss.

Changes to housing valuation will have an eventual impact on property tax revenues. That’s tough because for community colleges, property taxes are the only revenue stream not directly tied to enrollment. Community colleges could also feel the effects in terms of lower or later property tax collections. When homeowners are grappling with high interest rates and high inflation, they may not have much incentive to pay their property taxes in a timely way. Reduced tax collections could reduce revenues at a time when students are also under extreme financial pressure.

Moral of the story for higher education that’s being written right now? Don’t borrow or build.

Photo Credit: Wil C. Fry , via Flickr