A new analysis of federal education data conducted by the Federal Reserve Bank of St. Louis shows that higher instructional spending has a significant impact on students’ earning potentials following graduation. The effect was most pronounced between the most competitive schools and highly competitive schools.

Using data stored in the Integrated Postsecondary Education Data System (IPEDS), researchers isolated the effects of instructional spending on the income of students who graduated from schools classified as most competitive, highly competitive, very competitive, competitive and less competitive.

The researchers examined recent graduates’ earnings data reported to the US Department of Education in 2001 and followed up with earnings data from the same student cohorts in 2011. Graduates of the most competitive schools reported average annual earnings of $65,400 in 2011, which was 26% higher than earnings of students who attended highly competitive schools ($52,000). Those who attended the most competitive schools outearned those who attended the least competitive schools by 75% ten years after graduation.

There are many factors that account for a degree’s income potential, and instructional spending is just one of them. Beyond verifying that students who attended top-tier higher education institutions continued to earn more than students who attended less competitive schools, the researchers wanted to know how much of an influence instructional spending had on student earnings.

Following their analysis, they determined that instructional spending by a student’s alma mater accounted for almost one-third of the students’ earnings following graduation. In the study period, the most competitive schools spent an average of nearly $20,000 per student on instruction, whereas the least competitive schools spent an average of about $3,800 per student on instruction.

The analysis suggests that spending more on instruction produces a higher income potential for students, thereby increasing the value of the students’ degree.

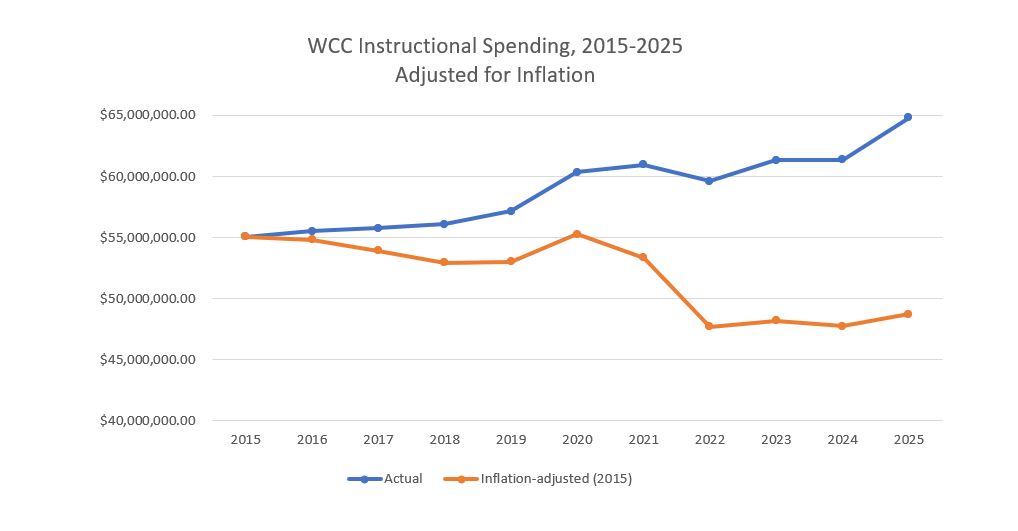

WCC’s instructional spending doesn’t keep pace with inflation

In both 2020 and 2022, I wrote about the impact of inflation on WCC’s instructional budget. When accounting for inflation, WCC has spent less on instruction over time. One could argue that with fewer students, the drop in instructional spending is to be expected. After all, fewer students should equate to lower instructional expenses, right?

When you look at WCC’s instructional budget over the last decade (expressed in 2015 dollars) WCC spends less on instruction now than it did a decade ago.

If WCC were serious about increasing the value of a student’s degree, the fastest and most effective way to do this would be to devote more of its budget to instruction. For the last four fiscal years, the inflation-adjusted instructional budget has been largely flat. WCC has made no new investments in instruction that it did not offset by reductions elsewhere.

So, can we assume that the WCC Administration has no serious interest in improving the earning potential of its degrees? Or that it has no intention in making new investments in instructional programming? Or both? WCC’s instructional budget data certainly suggest that.

Photo Credit: 401(K) 2012 , via Flickr