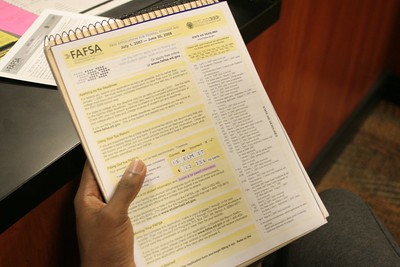

Current data on the Free Application for Federal Student Aid (FAFSA) show that fewer students are seeking financial aid. That’s not a good sign for colleges and universities around the country. It’s especially bad for community colleges.

Many students who are eligible for federal financial aid don’t know how to access the system to request help. In normal years, high school counselors help students learn about and complete the forms. In addition, students encounter FAFSA information when they take the SAT or ACT. The pandemic has changed that. Many universities have temporarily suspended the requirement that applicants provide SAT or ACT scores. High school students may or may not have attended classes in person. This means they may not have encountered a high school counselor.

The result is that fewer high school students (13% in Michigan) have filled out the FAFSA in 2021 compared to 2020. Overall cost of attendance at a student’s chosen institution also plays a role in FAFSA completion. As part of the admissions and enrollment process, four-year universities provide information about the form and how to access it. Their cost of attendance can be a big incentive to fill out the forms.

Washtenaw County FAFSA completion rates show opportunity, risk

For students who haven’t made fall plans, that missing information can have a big impact on them. Currently, only a few Michigan high schools are reporting a 100% FAFSA completion rate among their graduating seniors. All those schools are either private or charter high schools. None of them are in Washtenaw County.

Of all Washtenaw County high schools, Central Academy currently has the highest completion percentage. AC Tech has the lowest. Surprisingly, Washtenaw Technical Middle College has the second lowest FAFSA completion percentage among Washtenaw County high schools. Less than one-third of WTMC’s graduating seniors have applied for federal financial aid for the 2021-22 academic year. That suggests that 2 of 3 2021 WTMC graduates will not continue their studies at a four-year institution. (That’s one of the selling points of WTMC.)

WCC has an opportunity to boost enrollment among what it professes to be its coveted student demographic- recently graduated high school seniors. But the opportunity is short-lived. June 30 is the state deadline for applying for federal financial aid for the upcoming academic year. The benefit of getting students to complete the form is that it makes more cash available for these students to attend school in the fall. The downside of not doing it is that private, for-profit schools are targeting these prospective students. And winning.

Private, for-profit schools are beating public institutions to the punch when it comes to recruiting students. By providing more information, more contact, more coaching and more support, they’re successfully reaching students. Even though students will spend more on post-secondary education, owe more in student loan debt, and make less by attending a private, for-profit college, students are choosing that route over all other options.

Change student recruiting to change enrollment results

Much of it comes down to what information is available to the students and when. Community colleges have been the big losers so far in the race to win the Class of 2021 Sweepstakes. So, it’s more than a little disingenuous of WCC’s president to complain about the scarcity of high school graduates, when WCC doesn’t put the same energy into recruiting high school graduates that private, for-profit schools do. For the most part, WCC relies on high school counselors to do that kind of heavy lifting. In a normal year, that may work. Because the competition for students is changing, WCC needs to change its approach to recruiting students in its target demographics.

And until WCC has maximized its enrollment through recruiting students in its target demographic(s), the WCC Trustees should not authorize any get-rich-quick schemes that generate non-mission-centric revenue.

Photo Credit: The Bent Tree, via Flickr