I’ve written a lot about revenue-backed bonds, WCC’s choice for obligating Washtenaw County taxpayers without actually asking them. But there is real danger in revenue-backed bond issues, as one institution demonstrates.

Birmingham Southern College is a small, liberal arts college in Birmingham, AL, founded in 1865. In 2002, Birmingham Southern issued 30-year revenue backed bonds to the tune of $13.5M with a coupon rate of more than 6%. The bond series has a final maturity date of 2031.

The college is small – at the time of the bond issue, it had 1,380 students. Because Birmingham Southern is a private university, the size of the bond issue meant that the students would each pay about $400 per year on average to ensure the bonds’ repayment.

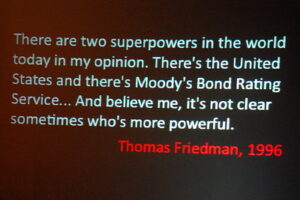

The bond was initially rated at Baa1, with a positive outlook. Within 13 months of issue, however, Moody’s downgraded the bond to Baa2. That began a regularly recurring downward ratings spiral for this bond issue. Earlier this year, Moody’s rated the remaining bonds as Caa2-.

Junk.

According to Moody’s:

“Obligations rated Caa are judged to be of poor standing and are subject to very high credit risk.”

The pandemic didn’t do anyone any favors, but it certainly didn’t help Birmingham Southern College. Since 2002, the enrollment at Birmingham Southern has dropped steadily. Currently, there are just over 1,000 students enrolled.

Revenue-backed bonds mortgage future operating dollars

Creditors look closely at enrollment. After all, tuition is the primary source of revenue for a private college. When enrollment declines, tuition rises for the remaining students. Birmingham Southern also has an endowment, which the administration has drawn on. Unfortunately, that has left the endowment with a $17M deficiency. To correct that, the administration plans to raise $100M for the endowment. Given the issue’s strongly negative outlook, that doesn’t seem very likely.

The poor credit rating will make future borrowing exceedingly difficult. It does, however, illustrate the danger of revenue-backed bonds. Thirty years is a long time. The investors’ initial assumption was that Birmingham Southern’s enrollment would stay the same or climb. It’s done the exact opposite, which has made repayment of the late-issue bond very challenging.

No one knows exactly what an institution’s long-term revenue picture will look like. Obligating the general fund to a debt whose horizon remains largely out of view is dumb. In this case, the debt stretches over three decades.

WCC set itself up similarly with the 20-year revenue-backed bonds for the Health and Fitness Center. Even at 20 years, that’s too distant to make reasonable projections about the college’s relative financial health.

WCC intends to use revenue-backed bonds for planned capital improvements. Placing additional burden on the General Fund is unwise when it is unclear how this Administration plans to raise enrollment. Over the past decade, the Administration has introduced mostly lackluster academic programs. They are primarily short-term (i.e., low revenue) and many of them have already been discontinued.

Just one more argument for not pursuing revenue-backed bonds, especially when the tax-backed option remains available for WCC’s use.

Photo Credit: Alan Levine , via Flickr