The WCC Administration will be the first to tell you that they need more money. If you looked more closely at that claim, you might think a little differently. Michigan’s community college funding model relies on three major sources of revenue: local property taxes, the state appropriation and student tuition and fees. Community colleges usually have some other sources of revenue, but in the grand scheme of things, they don’t contribute significantly to the institution’s bottom line.

Michigan law caps property taxes on a homeowner’s primary residence at the lower of the rate of inflation or 5%. The property tax cap certainly has an impact on how much money WCC collects from its four millages. (Two are permanent millages and two are renewable.) However, Washtenaw County has a lot of property that is exempt from this cap. The cap does not apply to rental real estate, second homes, vacant land and properties owned by businesses.

These “exceptions” can generate a lot of additional property tax revenue for WCC each time an exempt parcel’s assessment rises. In addition, the cap resets to the property’s actual value each time a primary residence changes hands. Whenever Washtenaw County experiences lots of residential real estate sales, property tax collections increase.

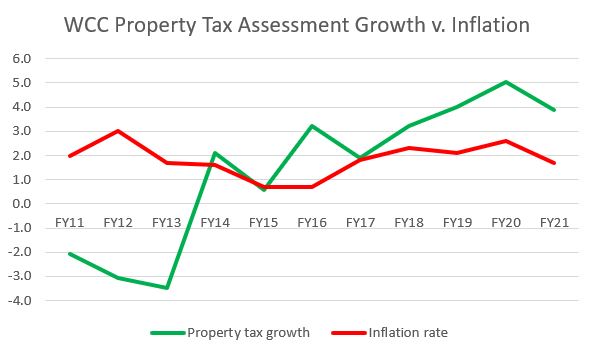

Looking at the growth in WCC’s property tax revenues relative to the rate of inflation is instructive. The effects of inflation can be devastating, so economists measure it monthly. At the end of the year, they average the preceding 12 months’ inflation rates to get an annual average inflation rate.

Property taxes are rising faster than inflation

The highest monthly inflation rate in the past decade was 3.9%. Last month (April 2021) inflation spiked to 4.2% from March’s inflation rate of 2.6%. Sharp price increases in production costs for goods, energy, housing, transportation or food, or sudden increases in demand can cause also cause inflation.

My point is that during the last decade, the rate of inflation alone has driven Michigan’s annual property tax cap. The cap has never hit that 5% “hard stop” because inflation has never risen that high.

So how has WCC fared in terms of property tax revenues? The chart compares the annual average rate of inflation (red) to the year-over-year change in WCC’s property tax revenues (green). Both data sets reflect a July-June fiscal year.

From FY 2011-FY2013, property tax collections dropped each year as the county felt the impact of the Great Recession. In 2014, the growth in property tax revenues exceeded the rate of inflation. Inflation narrowly won 2015, but since that time, WCC’s property tax collections have exceeded the rate of inflation.

What does this mean? Inflation affects everyone, including WCC. Its costs rise just like everyone else’s. However, the value of WCC’s property tax collections is outpacing inflation – sometimes by a lot. Property tax collections are WCC’s largest single source of revenue. WCC’s property tax collections not only enable WCC to absorb whatever inflationary cost increases it experiences but generates “bonus cash” for the College.

In FY20, for example, the average annual rate of inflation was 2.6%. At the same time, WCC’s property tax revenues increased by 5.1% – nearly twice as much.

WCC has plenty of money coming in. The question is, Where is it going? .

Photo Credit: Steven Depolo , via Flickr