For the last few days, I have looked at the impact of the Ann Arbor Greenbelt on both Ann Arbor and on the rest of Washtenaw County. With average sale prices hovering around $500,000 or more in some areas, affording a home in Washtenaw County has become a real question for people who want to move here – or in some cases – stay here.

To better understand what’s happening to residential real estate valuations, it helps to see how and where valuations changed between 2003 and 2023. Countywide, the value of residential real estate in Washtenaw County increased by 17.9% between 2003 and 2023. That’s notable because that increase reflects the impact of the Great Recession and the uneven recovery that Washtenaw County communities experienced.

Ann Arbor City

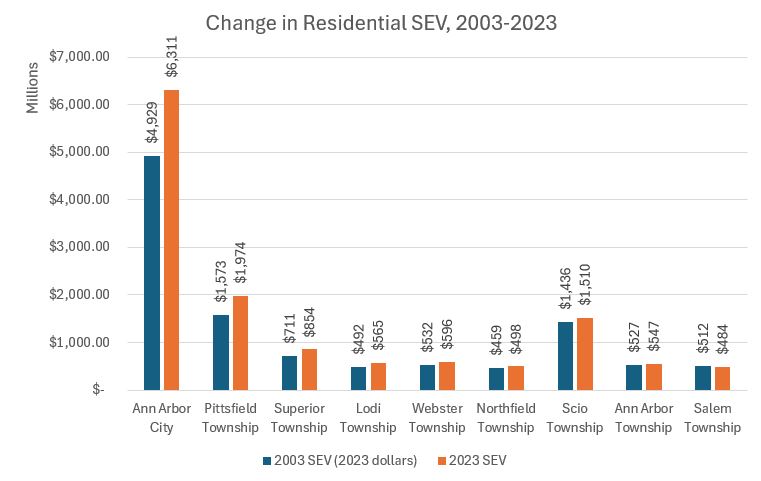

In 2003, the state equalized value of residential real estate in Ann Arbor in 2003 was $2,976,557,000. In 2023 dollars, that would be equivalent to $4,929,146,038. In 2023, the state equalized value of residential real estate in Ann Arbor was $6,310,660,600. That’s an increase of 28%, which well exceeds the countywide average increase.

Residential Values Inside the Greenbelt

What has happened to property valuations in cities and townships that are in the Ann Arbor Greenbelt? The graphic below shows what happened to the state equalized value of residential properties in the greenbelt municipalities. 2003 residential values are expressed in 2023 dollars.

Are Washtenaw County communities along for Ann Arbor’s Greenbelt ride?

Among the townships in the Ann Arbor Greenbelt, Pittsfield Township’s residential valuations increased by 25% – similar to the valuation increase in the City of Ann Arbor. Residential valuations rose in Superior Township by 20%.

These two municipalities are significant not only because they notched the highest property valuations of all Greenbelt townships, but also because Ann Arbor was least active in purchasing properties here. In areas where Ann Arbor purchased more properties, the residential valuations increased less. In Ann Arbor Township, where the City of Ann Arbor was most active in greenbelt purchases, residential valuations logged the second-lowest increase (4%) among all Greenbelt townships. Salem Township’s residential real estate decreased in value by 5.6% between 2003 and 2023. The average residential property valuation increase for all Greenbelt communities was 12.6%.

The City of Ann Arbor is the clear beneficiary among the cities and townships that make up the Ann Arbor Greenbelt, but what happened in the other cities and townships?

Residential real estate values outside the Greenbelt

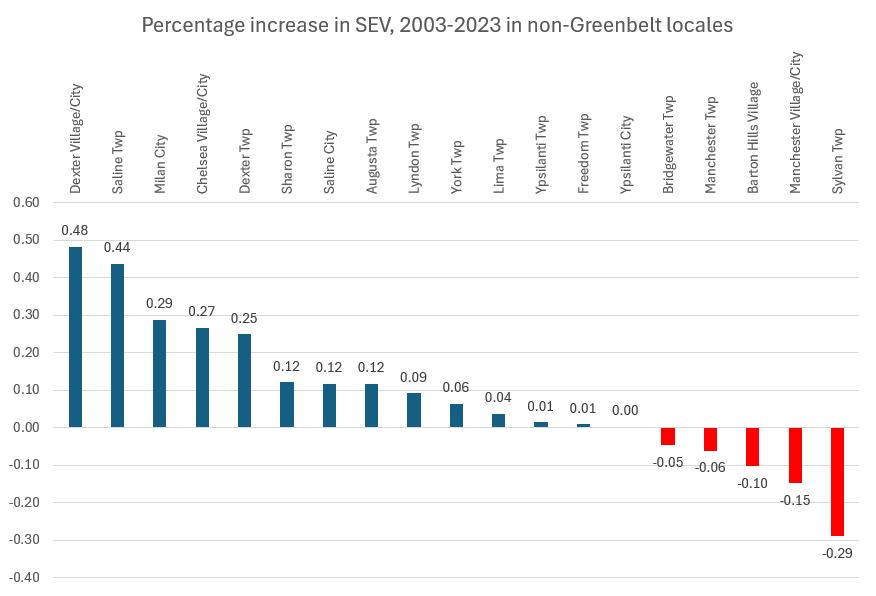

The chart below shows the inflation-adjusted residential valuation changes in non-Greenbelt areas between 2003-2023.

Real estate values in several municipalities outside the greenbelt rose much more dramatically than those inside the greenbelt. It raises the question of whether ceding development rights is the right choice over the long term for cities and townships in Washtenaw County. It raises another- and perhaps more important- question. Would real estate values in these excluded municipalities have risen so much over 20 years if Ann Arbor had not created a greenbelt? Is Ann Arbor’s quest to increase its own property values making other Washtenaw County communities unaffordable, too?

Tomorrow, I will look at the communities that ended up on the short end of the stick, and why these communities need Washtenaw Community College to increase the value of its degrees.

Photo Credit: Heritage Media , via Flickr