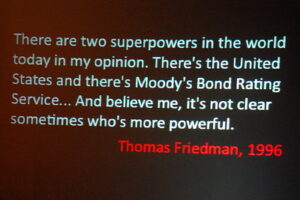

Even though Washtenaw Community College is one of the best-funded public community colleges in Michigan, the WCC administration continues to pursue revenue generation schemes that do not relate to the college’s primary mission. While this may increase the college’s revenue picture, unrelated business income (UBI) comes with its own challenges.

According to the Internal Revenue Service, UBI is revenue that does not substantially relate to the institution’s primary mission. Even though Washtenaw Community College is a publicly funded institution, its UBI is still taxable.

UBI includes a wide range of activities, from commercial activities that exploit the institution’s educational purpose(s) (renting restaurant and bookstore space) to building rentals to the public for non-College events to memberships to the Health and Fitness Center.

All these activities generate taxable revenue. The IRS has rules about just about everything, including UBI. Non-profits and institutions with tax-exempt status can get into trouble when they generate too much UBI. One of the risks, in fact, is the loss of one’s tax-exempt status. That happens when a tax-exempt institution spends too much time, effort and energy generating UBI at the expense of its primary mission.

Unfortunately, the WCC Administration consistently looks for ways to increase its “other revenue.” This is probably a spiral artifact of the amount of money that WCC diverts from the General Fund to pay the expenses associated with generating other revenue. It’s also an attempt to cover the administration’s over-inflated spending on itself.

Unrelated business income is a slow revenue leak

So, ideas like using taxpayer dollars to build a hotel (UBI) to support a convention center (UBI) and running a raft of summer trades programs (UBI) or a fitness center (UBI) for the purpose of turning a negligible net profit doesn’t seem like the best use of the taxpayers’ funding for education. In essence, the Administration is converting untaxable revenue to taxable income. This represents a loss for a college that is quite adequately funded by the taxpayers, the students, and the State of Michigan.

I have said this a thousand times: WCC does not have a revenue problem. It has a spending problem. If the Trustees would forcefully address the spending problem, they would eliminate any perceived (or actual) “need” for UBI. State law charges community college trustees with this responsibility. For some reason, the WCC Trustees believe that their job is to rubber stamp whatever spending request the administration makes. No matter what the purpose is. No matter what the cost is. And no matter what it does to the General Fund.

I have also said this before: we need to elect better Trustees.

Photo Credit: eFile989, via Flickr