I read an interesting article today about the ongoing struggle to find CPA students in Minnesota. The accounting profession, it seems, has been given a run for its money by sexier, better paying computer science occupations. The problem is so bad that the Minnesota Society of CPAs is now urging the Minnesota state legislature to approve “alternate pathways” to CPA licensure in Minny.

Some time ago, the state legislature there decided it would be a good idea to increase the educational requirements for CPAs. Today, a CPA student who wants to take the state’s licensing exam must present with 150 university credits and one year of work experience. While it may seem like a good idea, the number of first-time exam-takers dropped by about 20% after the state larded on the additional 30 credits. From a cost perspective, that could add $20,000 or more to a person’s total cost of attendance.

It also instantly created a shortage of newly minted CPAs. That shortage meant that those who did pay to earn the additional year of university credit suddenly commanded a much higher salary. The only employers who could afford to the new, higher-cost CPAs were the big accounting firms. And that’s just what they did, leaving smaller firms to hunt for new employees.

The increased salaries among new CPAs was a welcome event, as starting salaries had been stagnant for decades. So, it should come as no surprise that the number one and number two challenges facing accounting firms in Minnesota in 2023 are the search for talent and rising salaries.

Shortage of CPA Students is tip of the iceberg

A certain faction among CPAs believes that the pain that smaller accounting firms are currently feeling is the result of holding salaries constant (low) for decades. Had the profession done a better job of managing salaries for new CPAs, they would not be feeling the profit-threatening jolt that has come with competing for new talent.

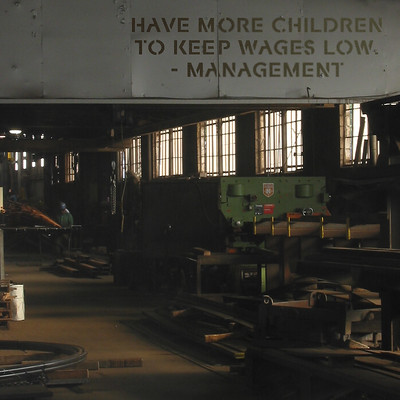

That was the part that was interesting to me. Holding salaries artificially low over a long period of time is a recipe for trouble down the road. When the dam does break – and it will in poorly compensated professions – it will make finding and paying employees that much harder.

CPAs aside, that very scenario is playing out among low-wage employers around the country. Those who don’t (or can’t) pay the prevailing wage for labor either go without or shut their doors. Chronic labor shortages lead to consolidation, technological advances, offshoring, obsolescence, and other events that tend not to attract students.

The point is that training people for professions that deliberately aim to keep wages low or stagnant turns out to be a great way to vastly remodel (or perhaps even eliminate) those professions. Community colleges happen to excel at that, possibly because they spend so much time catering to the short-term needs of employers without considering the long-term needs of either the student or the industry.

It’s also short-sighted for those community colleges that pursue training for low-wage occupations at the expense of new program development. When the low-wage programs are gone, the community college cupboard is left bare.

It’s time to let low-wage employers and low-wage occupations fend for themselves.

Photo Credit: …LIZ… , via Flickr