In Michigan, community colleges and the State of Michigan share construction funding responsibilities. Under most circumstances, the State of Michigan will fund as much as 50% of the cost of a construction project on a community college campus, provided that the project meets certain conditions. When a proposed project does not meet the State’s standards, the State deducts funding from its 50% share.

State funding depends heavily on the purpose of the building. Student-focused buildings – including academic and administrative buildings – qualify for the 50% funding match from the State. Buildings whose primary purpose is something other than student support may or may not qualify for reduced support. Buildings that provide minimal student support – like the Morris Lawrence Building and the Health and Fitness Center – do not qualify for state funding because the activities those buildings support are not primarily student-focused.

Conditions – like an accumulation of neglected maintenance – reduce the amount of funding available from the State. The State Legislature is unwilling to absorb the cost of maintenance projects – no matter how expensive or how necessary – that the community college failed to perform using its operating funds.

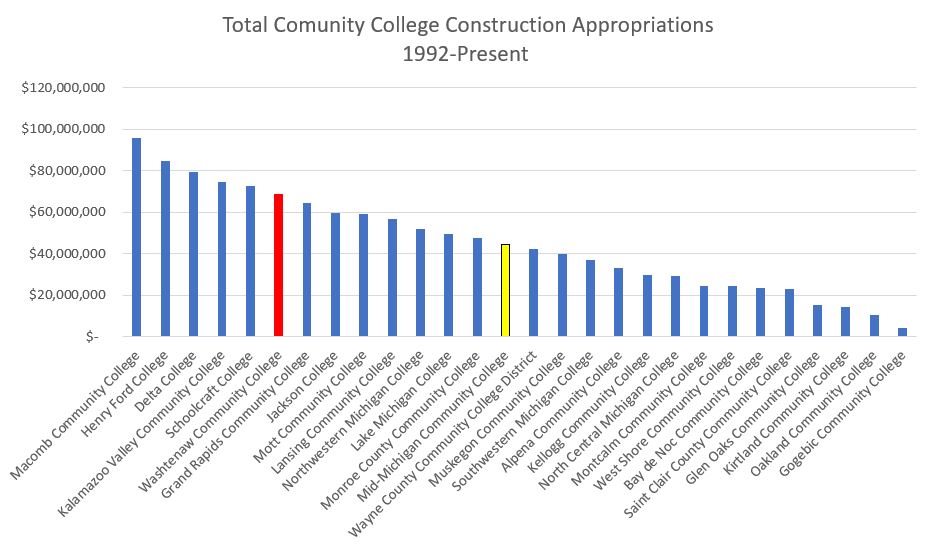

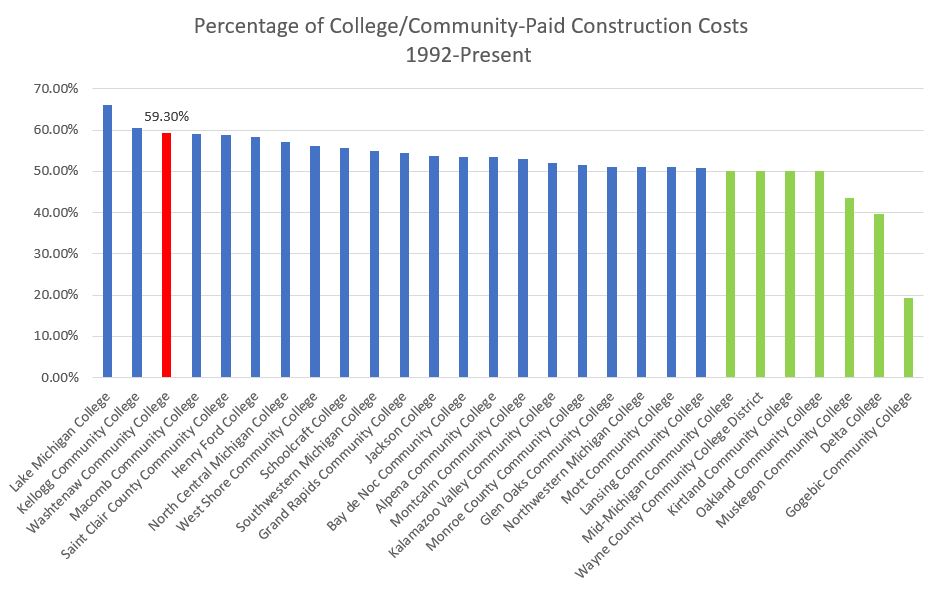

So, let’s look at Michigan community colleges and how well their construction projects over the last three decades have qualified for state funding.

Community college construction funding landscape

Since 1992, the State of Michigan has contributed more than $565M to capital projects on the state’s community college campuses. The chart below shows the total community college capital construction costs that qualified for at least $1 of matching funds from the State of Michigan. Just five community colleges spent more on capital improvements than WCC did in the previous three decades. The yellow bar indicates the average capital spending.

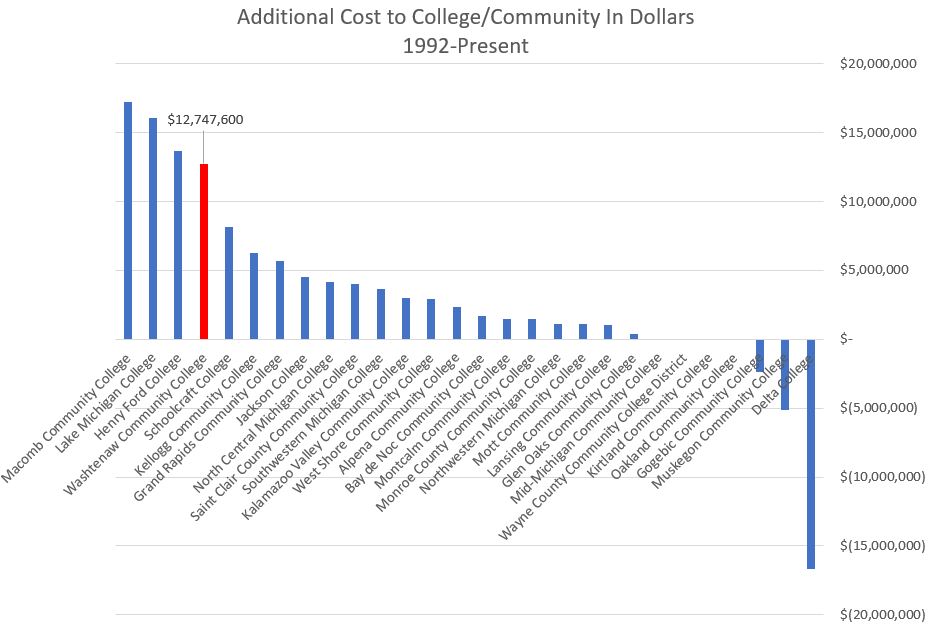

The chart below shows that taxpayers in WCC’s district and WCC students have absorbed the third-highest amount of unmatched construction costs since 1992. Put another way, WCC is the third least-efficient community college at capturing state matching funds for qualifying capital projects. The green bars identify campuses that maximized the state matching funds.

Being ineffective at capturing state matching funds is expensive for the students at WCC, primarily because the Board of Trustees refuses to seek tax backed bonds for capital projects. Seeking tax-backed bonds would nominally increase property taxes in the WCC district, but it would reduce tuition and make a college education far more affordable and accessible for Washtenaw County residents.

So, how much has this refusal to seek taxpayer assistance cost the students at WCC over the past three decades? The chart below shows that WCC’s failure to maximize state matching funds has resulted in an additional cost to students of nearly $13M.

The cost to students is probably much higher, especially for students who borrow to finance their educations. Also missing from the calculation are the students who stopped attending classes because they could not afford the massive tuition leaps needed to pay for construction that either did not qualify for the full state funding match or did not qualify for a match at all.

Failure to maximize state funding raises questions

That opens questions that WCC students should be asking.

Why should students pay for non-qualifying construction at all?Lack of value to students is the primary reason projects fail to qualify for state matching funds. If a project cannot qualify for state matching funds because the project lacks benefit to the students, why should the students pay for it through increased tuition?

Why is the Board of Trustees asking students to pay for neglected maintenance? A major reason projects fail to qualify for matching funding is the accumulation of neglected maintenance that a proposed project will address. Paying for campus maintenance isn’t the students’ responsibility.

Maintenance is – and should be – a basic expectation of every single person – students, staff, faculty, administration, vendors, Trustees, members of the public – who sets foot on campus. No one else is assessed a maintenance surcharge when they arrive on campus. Yet students pay for undone maintenance every time WCC raises tuition to pay for unmatched capital costs.

Ultimately, the buildings belong to the taxpayers of the district. And if the Trustees are too timid to ask the taxpayers to pay for the maintenance the administration has neglected to fund, perhaps the better policy is to prioritize maintenance and perform it in a timely way – when the cost to do so is as low as it is ever going to be.

Why isn’t the Board taking advantage of tax-backed bond issues? Tax-backed bonds are lower cost because they’re guaranteed by a taxpayer-authorized revenue stream. The lower interest rate over the life of the bond issue can save hundreds of thousands of dollars. By using general obligation (revenue-backed) bonds, the college pays more in interest and passes those costs on to students.

Photo Credit: Indiana Public Media, via Flickr